In 2009 Rolling Stone published an article by Matt Taibbi about Goldman Sachs. Taibbi writes: “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”1 The statement is rather unfair to vampire squids, but aside from that detail the characterization is quite appropriate and, moreover, equally applicable to the finance, insurance, and real estate (FIRE) sector as a whole.

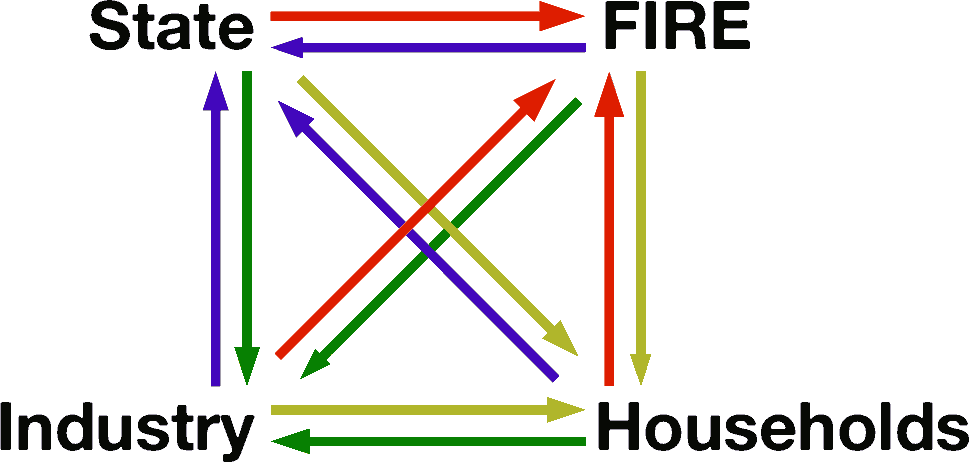

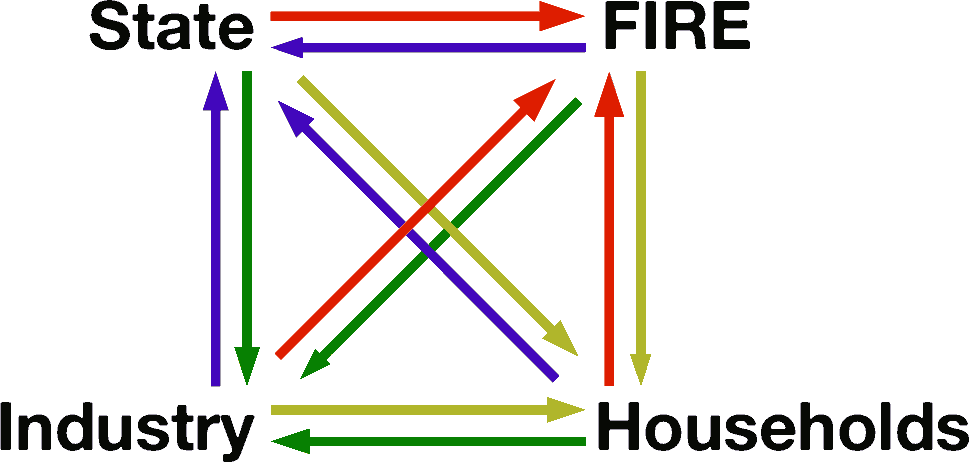

In Killing the Host, Michael Hudson describes the FIRE sector as parasitic.2 He writes that “instead of creating a mutually beneficial symbiosis with the economy of production and consumption, today’s financial parasitism siphons off income needed to invest and grow.” To understand the FIRE sector’s parasitic nature it is useful to separate it from other industries in a four-sector model of the economy.

“Industry” here refers to all other industries – manufacturing, agriculture, mining, trade, and so forth – hence, everything that is not covered by the finance, insurance, and real estate (FIRE) sector, households, and the state. Separating FIRE from industry (or “other industries”) in this way is somewhat uncommon in mainstream, “neoclassical” economics (for reasons that will be explained below), but was more or less standard in classical economics, although the labels differed. The classical distinction was between production (here industry) and rent extraction, which is now mainly (but not exclusively!) the domain of FIRE.

“Industry” here refers to all other industries – manufacturing, agriculture, mining, trade, and so forth – hence, everything that is not covered by the finance, insurance, and real estate (FIRE) sector, households, and the state. Separating FIRE from industry (or “other industries”) in this way is somewhat uncommon in mainstream, “neoclassical” economics (for reasons that will be explained below), but was more or less standard in classical economics, although the labels differed. The classical distinction was between production (here industry) and rent extraction, which is now mainly (but not exclusively!) the domain of FIRE.

Rent

“Rent” is a key term here. As a colloquial term it refers to the (usually) periodic payments obliged to the owner of some property one rents, such as (most commonly) house rent, but the term has a different – albeit related – meaning in classical economics. In that context rent is price minus value. Or in other words, rent is income that has no counterpart in (necessary) production costs. The most common kind of rent discussed by classical economists (such as Adam Smith) was land rent (or groundrent). Landlords own soil (and/or buildings) which farmers and others rent. The landlord’s costs for providing that soil (and/or building) – and thus its value (for classical economists, but not for neoclassical economists)3 – are negligible (or even zero). Consequently, the landlord’s income consists almost entirely of rent. Other kinds of rent are monopoly rents, interests on loans, and patents, for example. If a producer has a monopoly on some good in a market and uses this to sell for a price well above the production costs of that good, then the difference is rent. Typically, rent is income that is generated just by ownership or control of something (such as real estate, money, economic rights, a market, and so forth) rather than by producing something.

Adam Smith and other classical economists considered rent extraction parasitic.4 Rent extraction does not contribute to the economy but rather damages it, and a healthy economy must be protected from the economic damage done by rent extraction. For them, a “free market” was a market that is free from excessive rents (such as monopoly rents), but neoclassical economists have corrupted this idea and changed the concept of a free market into one in which rentiers (i.e. owners/controllers of rent-producing privileges) are free to extract as much rent as they want, effectively creating a “toll-booth economy”

Money flows

The arrows in the figure (repeated below) represent flows of money. They are color-coded by their destination. Blue arrows are payments by FIRE, industry, and households to the state. These are taxes mainly, but also include (much smaller) payments for specific goods and services provided by the state. Yellow arrows are payments to households such as salaries and welfare benefits. The yellow arrow from state to households also includes other benefits that the state provides to households such as education, health care, infrastructure, and so forth. Green arrows are payments to industry. This is sales income mostly, but it also includes state subsidies, for example, as well as the aforementioned other benefits (such as infrastructure and education) in so far as those apply to industry. The red arrows, finally, are payments to the finance, insurance, and real estate (FIRE) sector such as interests on loans, insurance premiums, house and land rents, and so forth. Arrows could be added to the figure to represent sector-internal payments – from company to company or from household to household etcetera – but I’ll ignore those as they are largely irrelevant here.

Ideally, the system as a whole is in balance. That doesn’t mean that the blue arrow from households to state and the yellow arrow in the opposite direction should represent (roughly) equal amounts of money, but that for each of the four sectors the sum of the three incoming flows should be roughly equal to the sum of the three outgoing flows (at least on the longer term). Unfortunately, the system is not in balance. It almost never is, because rents by their nature are (mostly) extractive: rentiers suck wealth out of the system without giving much (if anything) back. A few centuries ago, feudal landlords were the main rent extractors. In the modern world the FIRE sector has taken their place. Unless heavy restrictions are in place, incoming money flows are substantially larger in case of FIRE than outgoing flows, which is exactly why (most) classical economists argued for restrictions on banking and other rent-extracting activities.5 For this reason, the financial relations between FIRE and the other three sectors deserve some closer attention.

Ideally, the system as a whole is in balance. That doesn’t mean that the blue arrow from households to state and the yellow arrow in the opposite direction should represent (roughly) equal amounts of money, but that for each of the four sectors the sum of the three incoming flows should be roughly equal to the sum of the three outgoing flows (at least on the longer term). Unfortunately, the system is not in balance. It almost never is, because rents by their nature are (mostly) extractive: rentiers suck wealth out of the system without giving much (if anything) back. A few centuries ago, feudal landlords were the main rent extractors. In the modern world the FIRE sector has taken their place. Unless heavy restrictions are in place, incoming money flows are substantially larger in case of FIRE than outgoing flows, which is exactly why (most) classical economists argued for restrictions on banking and other rent-extracting activities.5 For this reason, the financial relations between FIRE and the other three sectors deserve some closer attention.

Households and FIRE

The main money flow between households and the FIRE sector consists of the payment of interests on loans, followed by amortization (paying back loans), and insurance premiums. The main reverse flow consists of insurance benefits payments (which are always delayed as much as possible). There also is a reverse flow of money in the form of salaries to FIRE employees, but aside from money transfers to the managerial elite, this flow is negligible. Moreover, because that managerial elite behaves more like an integral part of the FIRE sector than as a part of the households sector,6 payments to that elite are better represented as a sector-internal flow than as a flow from FIRE to households.

Payments to FIRE are almost unavoidable for the vast majority of people in industrial societies. Few people wholly own their house – they either rent it or financed its purchase with a mortgage in which case the house is collateral in case of a default (meaning that the bank will become the owner of the house). Consequently, the vast majority of people pay a substantial part of their income to FIRE, and FIRE doesn’t given them anything back for those payments. In case of a rented house, the owner is responsible for maintenance, of course, but typically that represents around 10% of the rent paid to the owner. And in the case of a mortgage, the inhabitant of the house gets nothing for her interest payments at all. Hence, these are big one-way flows from households to FIRE, and it shouldn’t come as a surprise that FIRE does everything it can to increase these flows. The more mortgages is can “sell”, the more money FIRE makes, and if someone lured in with false promises and shiny brochures can no longer satisfy their financial obligations, the bank can always foreclose (i.e. sell the house).

The maximum a household can pay in interests and amortization (or as rent) is whatever is left after daily necessities and other obligations, such as taxes and other debts, are taken care of. The financial sector aims to siphon off that surplus income, and the lower taxes, the more FIRE can siphon off. Market prices for houses and other real estate are determined by this ability to pay. Lowering taxes on real estate, for example, thus increases the prices of real estate because households will have more to spend on their mortgages. But if there is an unexpected rise in other household costs (food, taxes, other debts) or a fall in household income, then the mortgage becomes a millstone around the debtor’s neck. Somewhat similarly, the lower the interest rates, the larger the sum of money that can be borrowed relative to the household’s available income, but if interests rise so do the financial obligations of the debtor, regardless of whether she can actually pay.

In addition to mortgage debts, many households also have credit card debts or personal loans and/or study debts, as well as various insurances. All of these together assure that there are massive rivers of money flowing from households to the FIRE sector, and very little trickling down in the opposite direction.

Industry and FIRE

The textbook story about the relation between FIRE and industry is that FIRE provides industry with the loans to invest and grow. This is a myth. Investment in facilities, machines, research and development, and so forth is almost always financed out of a company’s cash flow and/or current assets, or by issuing stocks. If companies borrow money from banks it is almost never to invest in new production facilities, but either to take over already existing production facilities or to buy back stocks. Historically, banks have never played a significant role in productive investment. Business loans were for bridging temporal gaps between expenses and expected income – between sowing and harvesting, for example, or if there is a large distance between the places were goods are bought and were they are sold – and banks remain unwilling to lend money for investment in new production. The myth that banks provide the capital needed for growth is nothing but propaganda for banks – it is an attempt to make banks seem beneficial. In reality they aren’t. The relation between banks and industry is parasitic rather than beneficial.

One of the ways in which FIRE sucks money out of industry is by forcing companies to buy back stocks. The FIRE sector “invests” in stocks of asset-rich companies and then forces those companies to sell assets and/or loan money to buy back stocks. Buying back stocks reduces the total number of stocks in that company, but does not change the perceived value of the company. Thus, the value of the company per stock increases if there are less stocks, and therefore, the stock price rises, making stockholders richer. The ideal scenario for a bank is the following. (1) Buy stocks in company X. (2) Force the company to sell its assets to buy back stocks and to pay large dividends to its stockholders. (And thus to receive increased dividend payments.) (3) After all assets are sold (and the company is “asset-stripped”), force the company to borrow money to buy back more stocks. (4) Sell stocks for the increased stock price (and make a big profit on that price increase in addition to the dividend payments and the profit from the loan to the company for buying back the stocks), and leave the company without much of its prior assets and with a big loan (requiring it to pay interest to the bank out of the cash flow it could have used for investment in production otherwise). This is not the only way in which banks extract money from industry, and it’s probably not even the most nefarious, but it nicely illustrates the real relation between FIRE and industry – that relation, again, is parasitic rather than beneficial. As is the case for households, there is a large flow of money to FIRE, but merely a trickle in the opposite direction.

State and FIRE

The main money flow from FIRE to the state consists of taxes, but FIRE has managed to make most of its activities tax-exempt or subject to very low tax rates. Conversely, money flows from the state to FIRE in the form of interest payments on bonds and loans. And FIRE has been as successful in increasing this money flow as it has been in decreasing its tax payments.

The main taxes that affect FIRE are taxes on property (real estate especially) and on rent. If these are lowered (or even abolished) then the state needs to find alternative sources of revenue or cut its expenses. In theory, a state could just print (some of) the money it needs, of course, but in practice that is never an option as FIRE has effectively taken this power out of the hands of states and reserved it for itself. It is now FIRE that creates money (but with a few computer keyboard strokes rather than by printing it), rather than the state. The only source of structural alternative revenue is raising other taxes. The prime candidates for taxes to be raised are taxes on labor and consumption. The effect thereof is to increase the costs of production for industry and the costs of living for households. If households have less to spend due to a tax increase this also affects industry because the less consumers buy, the less industry sells. Consequently, raising taxes on labor and consumption (beyond a certain level) hurts the economy.

Incidental (rather than structural) alternative revenue can be raised either by borrowing money (from FIRE) or by selling of state assets – that is, privatization. Either source of revenue is limited, however. Banks won’t lend a state infinite amounts of money and states don’t have infinite supplies of assets they can sell either. Furthermore, privatization is rarely an important source of revenue. Privatization is the social/political equivalent of the asset-stripping mentioned above, but is done mainly for ideological reasons. It is motivated by the hegemonic belief that “the market” can run the privatized operations and services more efficiently than the state. This, however, is a false belief, as the “customers” of privatized public transport, mail, and utilities in most countries can testify – privatization almost always raises costs rather than that it reduces them. The main reason for this is that as soon as a business becomes privatized, FIRE starts extracting money from it (in the form of interest payments, dividends, etc.). And because of that, FIRE profits much more from privatization than the state and/or its citizens (i.e. households). The other and more important source of incidental revenue, borrowing money, also primarily benefits FIRE, but that should be obvious: the more the state borrows, the more interests it has to pay to FIRE.

If a state refuses to tax FIRE or taxes it insufficiently it can raise the financial burden on households and industry instead and/or increase incidental revenue, but there are limits to both. Sooner or later there is nothing left to privatize, there is insufficient revenue to be able to get more loans, and taxes on labor and consumption become an obstacle to economic growth and, therefore, start generating less (rather than more) revenue. At that point only the last tool in the toolbox, cutting costs or austerity, remains. But austerity only further hurts the economy by further reducing the money that households and industry can spend and by (slowly) crippling the infrastructure needed for the economy to function efficiently. (Austerity can be very profitable to FIRE, on the other hand, as it may push the state to privatize what was previously never considered as a possible candidate for privatization.)

All of this has the combined effect of creating a large flow of money from the state to FIRE and only a trickle from FIRE to the state, but the “Great Recession” of 2008 has revealed that this imbalance is actually even worse. Most of the profits of the FIRE sector are made in activities that are euphemistically called “investment banking”, but that really aren’t investments (or at least not investments in industry or productivity growth in general) and that have fairly little to do with banking in a more traditional sense. Investment banking is really a mix of gambling, ponzi schemes, and other deceptions hidden behind layers of obscure terminology and esoteric (and nonsensical) mathematics. The main problem with investment banking, however, is that while FIRE takes all the profits, in the Great Recession the state became responsible for the losses. Imagine going to a casino – if you win, the winning are yours; if you lose, the state covers your losses. That is really what the bank bailouts of the Great Recession were: the state covering the gambling losses of FIRE. And the excuse for that was that otherwise the financial system would collapse and the world economy would go down in flames, but that is an ideologically motivated lie. The rest of the economy – or the real economy – is not dependent on the “financial system”. In the contrary, the “financial system” is a parasite sucking money and energy out of it.

Crisis

Money flows from industry, states, and households to the finance, insurance, and real estate (FIRE) sector with little flowing in the opposite directions. This cannot continue forever, however. Debts have a tendency to increase (often exponentially), and consequently, interest payments also increase.7 The growth of debt is the main (but not the only) cause of the continuous growth of the river of money flowing toward FIRE. (The main secondary cause is “investment” by FIRE of some of its profits in other kinds of rent-producing privileges such as real estate.) At some point, however, payments to FIRE become so large that industry can no longer invest in productivity growth, households can only afford the bare necessities (because much of their income goes straight to FIRE), and the state no longer has sufficient revenue to invest in infrastructure, to stimulate growth, to alleviate poverty, and so forth. At that point, the real economy (i.e. everything but FIRE) can no longer grow. But rent extraction relative to the size of the real economy continues to increase (either because of a further growth of debts, or because of economic contraction due to declining consumption, or both), and consequently, from this point onward, financial obligations to FIRE exceed the ability to pay. Industry no longer has sufficient revenue to pay their workers and suppliers and to pay FIRE; and households no longer have sufficient income to buy daily necessities and what they owe to FIRE (which further reduces the revenue of industry). This is when the economy collapses. When the sum of debts of households and industry is approximately 150% or more of GDP, crisis is almost inevitable.8 Usually the crisis starts a little bit earlier, however. Already before industry and households owe more to FIRE than they can pay, the growth of FIRE itself starts to slow down because the number of new loans starts to fall. And because FIRE is used to (almost) exponential growth rates (and may even depend on it for its profits), such a slow-down leads to a panic, which spreads to the rest of the economy.

The result of economic collapse or crisis is a very large (and growing) number of debts that cannot be repaid. The only real solution for that is debt cancellation, either by means of a wave of bankruptcies (as in the Great Depression in the 1920s) or a “debt jubilee”, a cancellation of some or all debts by the government. A debt jubilee is really only possible if the state owns and controls FIRE, which was the case throughout most of financial history. (And consequently, throughout much of that history, debt jubilees were common occurrences.) In the Great Recession (2008), bankruptcies were avoided as much a possible by means of a cash gifts from the state to FIRE totaling trillions of dollars, and because of that, most of the debts of households, industries, and states to FIRE remained in place. This turned several economies into what Steve Keen calls “debt Zombies”.9 A debt zombie economy is characterized by economic stagnation because households and industry have no or very little money left after paying FIRE, and without consumption and investment an economy cannot grow. A debt zombie is kept in limbo at the edge of economic collapse. As long as the state is willing and able to keep the national economy in limbo (mainly by subsidizing FIRE) is can stay there, although it is not unlikely that continuing economic stagnation leads to a gradual breakdown of civic society and to destabilizing violence or even revolt. (On the short term, stagnation leads to growing inequality, unemployment, and poverty, to a (further) deterioration of public services and of trust in the government, and to a rise of (usually far right) populist movements preying on insecurity and fear.)

Power

At this point you are probably wondering how FIRE gets away with this. (Or at least, you should be.) The answer is fairly simple: power. FIRE controls much of the economic decision making by means of direct and ideological power. Michael Hudson (partially) explains this power/control by comparing “investment banking” to parasitism:

Modern biology provides the basis for a . . . social analogy to financial strategy, by describing the sophisticated strategy that parasites use to control their hosts by disabling their normal defense mechanisms. To be accepted, the parasite must convince the host that no attack is underway. To siphon off a free lunch without triggering resistance, the parasite needs to take control of the host’s brain, at first to dull its awareness that an invader has attached itself, and then to make the host believe that the free rider is helping rather than depleting it and is temperate in its demands, only asking for the necessary expenses of providing its services. In that spirit bankers depict their interest charges as a necessary and benevolent part of the economy, providing credit to facilitate production and thus deserving to share in the surplus it helps create. 10

As mentioned, FIRE’s control depends on direct and ideological power. The main source of direct power is personal. In most industrialized countries (and probably also in many other countries) the people in charge of economic decision making – ministers of finance, central bank presidents, top bureaucrats, and so forth – all have close links to FIRE. Goldman Sachs has been particularly successful in getting its managers in top government positions. And many CEOs and business leaders also have close ties to the financial sector. In this way, FIRE directly controls much economic decision making – it is their pawns who make all the important decisions.

Ideological power may be even more important, however. Ideological power is, as Hudson phrases it, “making the host believe that the free rider is helping rather than depleting it”. Ideological power is making the state, industry, and households believe that FIRE is beneficial rather than parasitic, and therefore, that FIRE should not be hindered by regulation or political interference. FIRE has been incredibly successful in this respect. Its main tool of ideological power is mainstream, “neoclassical” economics. Mainstream economics if ideology (or religion) posing as science. It has chosen to ignore economic reality and to leave debts and the financial sector out of their models. (And in addition to that, their models are incoherent, based on obviously nonsensical assumptions, empirically false, and practically useless, except as ideological tools, which is, of course, exactly what they are.11) FIRE and mainstream economics have been so successful in spreading their self-serving ideological dogmas that almost everyone believes in them – the “free” press uncritically repeats all the propaganda they produce and politicians of all major parties in all so-called “democracies” are devout believers in the religion of neoclassical economics (and its political arm, neoliberalism).

As mentioned above, classical economists made a distinction between industry and rent-extraction (i.e. FIRE). This distinction underlies the four-sector model, but by refusing to make this distinction and grouping industry and FIRE together, the parasitical nature of FIRE is completely hidden. Similarly, by ignoring the classical distinction between industry and rent-extraction in measuring GDP an economy can seem to grow when its productive industry is really deteriorating and it is only the financial sector that grows (by preying on the real economy). But such growth is fake growth: it isn’t the economy that is growing but merely the parasite that is sucking the life out of it. When a mainstream economist mentions debt and loans, it is always to claim that loans allow companies to invest in new production, which as mentioned above, is a blatant lie – it is propaganda intended to make banks look useful. (Banks almost never lend money for this kind of investment, and never have.) Furthermore, by ignoring debt, the models of mainstream economics cannot predict economic crises. The handful of economists who predicted the Great Recession of 2008, for example, were all non-mainstream economists and all awarded a key role to debt in their models and theories. All that the models and theories of mainstream economics are “good” for, is (again) “making the host believe that the free rider is helping rather than depleting it”.

Solutions

Part of the solution to the problems sketched above is obvious: FIRE should be controlled by the state. As mentioned above, throughout much of financial history (i.e. the part of human history during which (something like) money, loans, and debts existed) the state either directly or indirectly controlled banking. Often it wasn’t the state itself that functioned as bank, but religious institutions, but those were also ultimately controlled by the state. And consequently, if debts started to weigh too heavy on the economy, the state could cancel them in a debt jubilee. Until fairly recently, important parts of FIRE remained under government control and those that weren’t were limited by laws and regulations. But FIRE has managed to turn the economic world upside down: it is now FIRE that controls the state instead of the state controlling FIRE, and that is a recipe for economic disaster.

FIRE has no interest in limiting debt and rent extraction. In the contrary – it depends for its profits on continuous growth thereof. That is impossible, of course, leading to crisis and/or stagnation, at which point FIRE (through direct and ideological power) lets the state pick up the bill. Ultimately, it is industry and households who are paying. To avoid economic crisis and/or stagnation, the sum of private debt (i.e. debts of industry and households) needs to be well below 150% of GDP (probably even below 100%). Debt and rent extraction cannot grow infinitely and must restrained. And when debts can no longer be repaid, they must be canceled. The only way to realize this is by bringing banks under state control. Furthermore, state control is also the only way to make banks play their supposed beneficial role: lending money for productive investment.

Nationalizing FIRE is insufficient, however, if other kinds of exploitative rent-extraction are left in place. Natural monopolies should be brought under democratic control (i.e. nationalized), patent laws should be revised (and limited to relatively short periods), speculative stock-trading should be limited and derivatives abolished, and to avoid exploitation through ownership of real estate it may be necessary to regulate or even nationalize real estate as well. Of all measures, bringing the financial sector under democratic control (i.e. state control, assuming that the state is at least somewhat democratic) is by far the most important.

A free economy – as the classical economists, including Adam Smith, were well aware – is an economy free of excessive rent extraction. Realizing that requires restraining or preferably even nationalizing the finance, insurance, and real estate (FIRE) sector. Private banks cannot be trusted because their interests and the interests of the rest of the economy (that is, the real economy) are diametrically opposed. Bankers are thieves and parasites. Society needs to be protected from them.

If you found this article and/or other articles in this blog useful or valuable, please consider making a small financial contribution to support this blog 𝐹=𝑚𝑎 and its author. You can find 𝐹=𝑚𝑎’s Patreon page here.

Notes

- Matt Taibbi (2009). “The Great American Bubble Machine”, Rolling Stone July 9-23: 52-61 & 98-101. p. 52.

- Michael Hudson (2015). Killing the Host: How Financial Parasites and Debt Bondage Destroy the Global Economy (Petrolia: Counterpunch Books).

- For neo-classical economists value equals price and thus there is no such thing as rent by its classical definition.

- Most of them didn’t use that term, however. The main exception is Karl Marx, who on several occasions used terms like “parasitic” to describe usury and other forms of rent extraction.

- Rather unsurprisingly, the main exception were economists that were closely affiliated with banking such as David Ricardo.

- Most of this “household” income of the financial elite is spent in a way that is more typical of the FIRE sector than that of households – that is, it is invested in real estate and other rent-extracting privileges, rather than used for consumption.

- Which wouldn’t be a problem if they would increase slower than the infl;ation rate, but that is almost never the case.

- Although it can be postponed by the state at considerable costs.

- Steve Keen (2017). Can We Avoid Another Financial Crisis? (Cambridge: Polity).

- Michael Hudson (2015). Killing the Host: How Financial Parasites and Debt Bondage Destroy the Global Economy (Petrolia: Counterpunch Books).

- See also Economics as Malignant Make Believe and Economics and Psychopathy. It is, by the way, no coincidence that almost all prominent mainstream economists are also on the payroll of FIRE.